There are a few key trends to look out for if we are to define the next multipacker. In an ideal world, we would like a company to invest more capital in its business, and ideally the return on that capital would also increase. Ultimately, this shows that this is a business that reinvests profits with a higher rate of return. With that in mind, Rockwool’s (CPH:ROCK B) ROCE is looking good right now, so let’s see what the throwback trend has to say.

If you haven’t used ROCE before, it measures the “revenue” (earnings before tax) that a company earns from the capital it uses in its business. Analysts use this formula to calculate mineral wool:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Thus, ROCE Rockwool is 16%. In absolute terms, this is quite a normal return, slightly close to the construction industry average of 14%.

In the chart above, you can see how Rockwool’s current ROCE compares to its previous return on equity, but there are only a few lessons you can learn from the past. If you are interested, you can view analyst forecasts in our free Analyst Forecasts for Companies report.

Although the return on equity is good, little has changed. ROCE has remained at around 16% for the last five years and the business has invested 65% of its capital in its operations. However, with ROCE at 16%, it’s good to see businesses continue to reinvest with such impressive returns. In this case, stable returns may not be very exciting, but if they can be sustained over the long term, they often provide great returns for shareholders.

After all, Rockwool has proven that it can fully reinvest capital at a good rate of return. However, the stock has fallen 18% over the past five years, so the drop could present an opportunity. That’s why we think further exploration of these stocks is worthwhile, given the attractive fundamentals.

If you’d like to explore Rockwool further, you might be interested in reading about 1 red flag found in our analysis.

While Rockwool may not be making the highest returns right now, we’ve compiled a list of companies currently earning over 25% return on equity. Check out this free list here.

Any feedback on this article? Care about content? Contact us directly. Alternatively, send an email to the editors at (at) Simplywallst.com. This article on Simply Wall St is general. We provide commentary based solely on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to provide financial advice. This is not advice to buy or sell any stock and does not take into account your goals or your financial situation. Our goal is to provide you with long-term focused analytics based on fundamental data. Please note that our analysis may not take into account the latest announcements of price-sensitive companies or quality materials. Wall Street has no positions in any of the stocks mentioned.

Find out if Rockwool could be overvalued or undervalued by reviewing our comprehensive analysis, which includes fair value estimates, risks and cautions, dividends, insider trading and financial condition.

Simply Wall St’s editorial team provides unbiased, fact-based reporting on global equities using deep fundamental analysis. Learn more about our editorial guidelines and team.

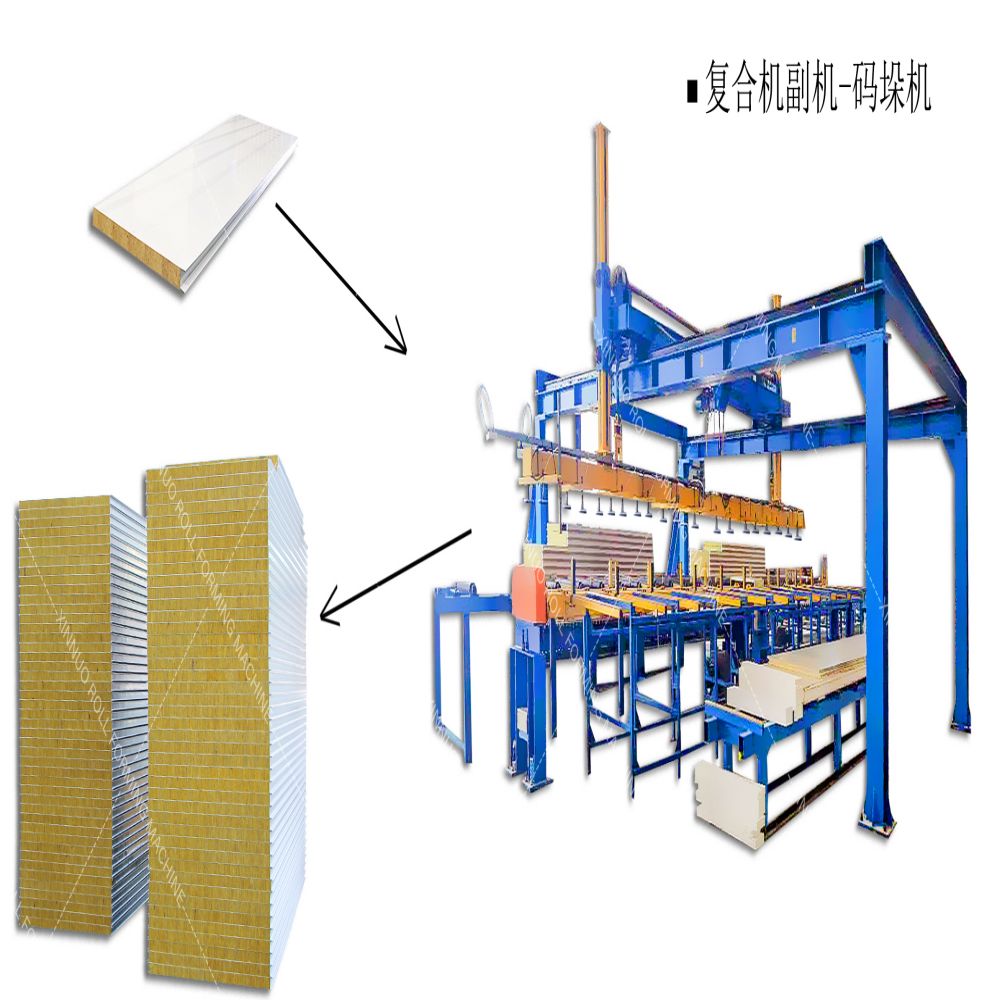

Rockwool A/S manufactures and sells mineral wool insulation in Western Europe, Eastern Europe, North America, Asia and overseas.

The snowflake is a visual summary of the investment, and the score on each axis is calculated over 6 checks in 5 areas.

Simply Wall St’s editorial team provides unbiased, fact-based reporting on global equities using deep fundamental analysis. Learn more about our editorial guidelines and team.

Rockwool A/S manufactures and sells mineral wool insulation in Western Europe, Eastern Europe, North America, Asia and overseas.

The snowflake is a visual summary of the investment, and the score on each axis is calculated over 6 checks in 5 areas.

Simply Wall Street Pty Ltd (ACN 600 056 611) is an authorized representative of Sanlam Private Wealth Pty Ltd (AFSL No. 337927) (Authorized Representative Number: 467183). Any advice contained on this website is general in nature and has not been prepared with your goals, financial situation or needs in mind. You should not rely on any advice and/or information contained on this website and we recommend that you consider whether it is appropriate for your circumstances and obtain appropriate financial, tax and legal advice before taking any investment decision. Before you decide to get financial services from us, please read our guide to financial services.

Post time: Oct-14-2022